Affordable Health And Wellness Insurance Policy Options to Safeguard Your Future

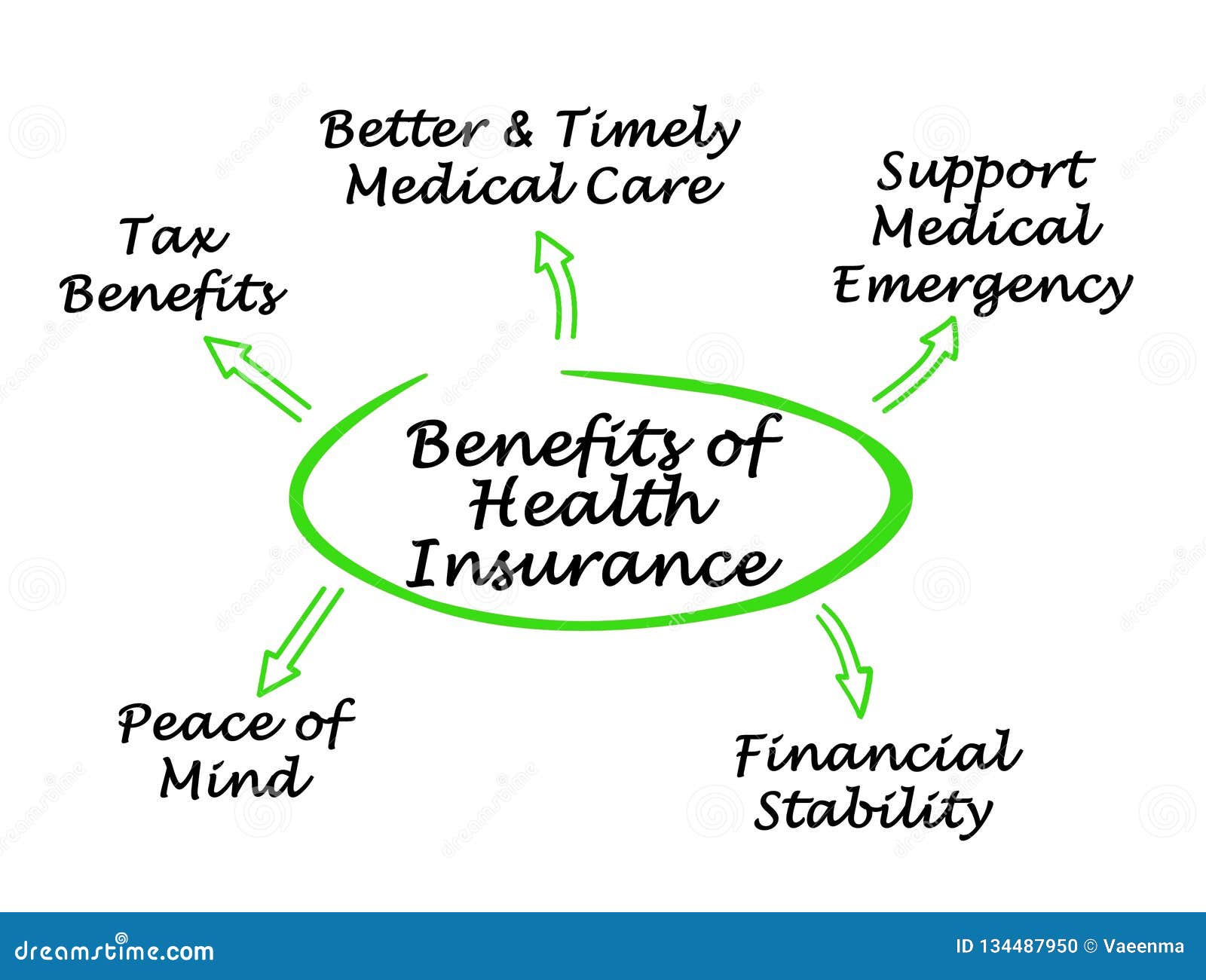

In today's uncertain times, safeguarding sufficient medical insurance protection is vital to protecting your future well-being. With a huge selection of alternatives available in the market, discovering inexpensive solutions that meet your requirements can appear like a daunting task. Nonetheless, understanding the intricacies of various wellness insurance coverage plans and how they straighten with your one-of-a-kind scenarios can make a significant distinction in both your financial stability and accessibility to quality healthcare. By checking out a variety of options from Wellness Savings Account (HSA) prepares to Team Health Insurance coverage alternatives, you can take positive steps in the direction of ensuring your comfort regarding your health and wellness and financial protection.

Affordable Medical Insurance Marketplace Options

Discovering the range of cost effective health insurance industry choices available can assist individuals locate a suitable plan that satisfies their certain needs and spending plan. The health and wellness insurance marketplace offers an array of strategies created to give coverage for vital health and wellness benefits at different rate factors. In Addition, High-Deductible Health And Wellness Program (HDHPs) combined with Health Savings Accounts (HSAs) supply a tax-advantaged method to conserve for clinical expenditures while using lower premiums and greater deductibles.

Health And Wellness Savings Account (HSA) Plans

When taking into consideration health and wellness insurance coverage options, one may locate that Health and wellness Savings Account (HSA) Plans supply a tax-advantaged method to save for clinical costs. HSAs are specific accounts that permit people with high-deductible health plans to set apart pre-tax bucks to pay for professional medical costs. Generally, HSA Program give people with a functional and tax-efficient means to handle their health care expenditures while conserving for the future.

Short-Term Health And Wellness Insurance Policy Solutions

Having covered the advantages of Health and wellness Savings Account (HSA) Strategies for handling medical care costs efficiently, it is essential to now shift focus in the direction of reviewing Short-Term Wellness Insurance coverage Solutions. Temporary health insurance policy usually supplies lower premiums contrasted to conventional health and wellness insurance strategies, making it a cost effective option for those seeking momentary insurance coverage without devoting to a lasting strategy.

One secret advantage of temporary health and wellness insurance is its versatility. While temporary wellness insurance might not cover pre-existing problems or supply the very same detailed benefits as long-lasting plans, it provides a valuable solution for individuals calling for immediate, short-term coverage.

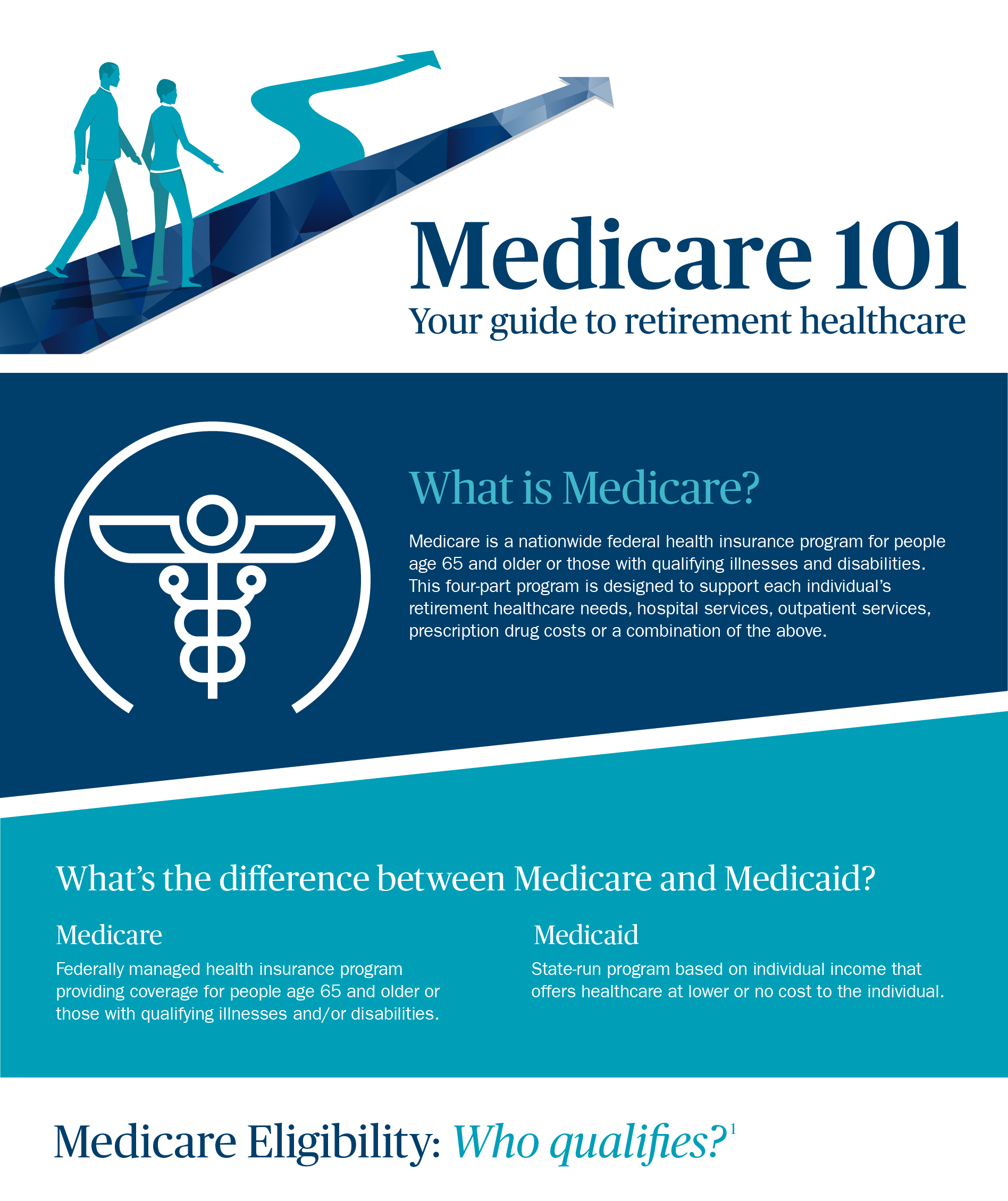

Medicaid and CHIP Coverage Benefits

Team Medical Insurance Program

Given the crucial function Medicaid and CHIP play in offering health care millennium insurance protection to susceptible populations, transitioning to the conversation of Group Wellness Insurance policy Plans is critical in discovering additional avenues for cost effective and detailed clinical protection. Group Health Insurance policy Plans are policies bought by companies and supplied to qualified employees as part of their advantages plan. One of the vital advantages of team wellness insurance policy is that it permits for the dispersing of danger amongst a bigger swimming pool of individuals, which can lead to lower premiums compared to individual plans.

Verdict

To conclude, there are various cost effective medical insurance choices offered to safeguard your future. Whether via the Health And Wellness Insurance Market, Wellness Interest-bearing accounts strategies, temporary insurance policy solutions, Medicaid and CHIP insurance coverage benefits, or team health insurance plans, it is very important to discover and choose the best alternative that fits your demands and spending plan. Taking proactive steps to secure medical insurance protection can provide assurance and financial security in bcbs ma case of unanticipated medical costs.